The rise of Donald Trump's Truth Social network on Wall Street is generating a buzz with the potential for billions of dollars in stock value. However, the former president may face obstacles in cashing out immediately, with concerns about the financial viability of the business in the long term. Trump's venture into the stock market hinges on a crucial vote scheduled for Friday by shareholders of Digital World Acquisition Corp., a blank-check company with the intention to merge with Trump Media & Technology Group (TMTG), the entity behind Truth Social. If the merger is approved, TMTG could see its stock trading on the Nasdaq, replacing Digital World. Shareholders of Digital World, acting as a special purpose acquisition company (SPAC), will vote on the proposed merger with TMTG, led by Trump as chairman.

SPACs like Digital World raise funds to acquire companies, offering a quicker route to public trading compared to traditional IPOs. While shareholder rejection is rare for such deals, the excitement surrounding Trump has driven up Digital World's stock price significantly, positioning the vote for approval. Many small-time investors, whether avid Trump supporters or seeking financial gains, have contributed to the surge in interest. Upon approval, Digital World will merge with TMTG, potentially retaining the DWAC ticker symbol initially before transitioning to a new symbol. Trump aims to trade under the DJT symbol, reflecting his initials and legacy in the business world. With a substantial ownership stake in the combined company, Trump's shares could be valued at over $3 billion based on the current stock price of Digital World. However, restrictions on selling shares, commonly known as lock-up provisions, prevent major shareholders from liquidating their holdings within six months of the deal's closure to prevent price instability. Despite Trump's financial obligations, including a significant lawsuit judgment, he faces limitations on selling company shares immediately. Exceptions to the lock-up agreement exist, such as transfers to family members, but strict adherence is required to avoid legal implications. While the possibility of waiving the lock-up agreement remains, any alterations would require board approval and justification to benefit shareholders. Notably, concerns about Trump's brand value and its impact on the company's future success could influence board decisions regarding share sales. The composition of the company's board, featuring prominent figures like Donald Trump Jr., Devin Nunes, Robert Lighthizer, and Linda McMahon, reflects Trump's influence and connections within the political and business spheres. However, potential risks associated with investing in the company, as outlined in regulatory filings, include Trump's voting power as a majority shareholder, the uncertain profitability of social media platforms, and TMTG's ongoing financial losses. Despite the stock's inflated price, experts like Jay Ritter caution against overestimating the company's value compared to its actual financial performance. In conclusion, the debut of Truth Social on Wall Street presents an intriguing opportunity for Donald Trump to capitalize on his business ventures. However, uncertainties surrounding the company's financial future and regulatory complexities may pose challenges to realizing the full potential of the investment. Investors and stakeholders alike must carefully consider these factors before deciding to support Trump's foray into the stock market.Trump's Truth Social Network Wall Street Debut Could Result in Billions in Stock Value

6 months ago

2481

6 months ago

2481

- Homepage

- Business & Finance

- Trump's Truth Social Network Wall Street Debut Could Result in Billions in Stock Value

Related

Impending Work Stoppage at Canada's Top Railroads May Disrup...

1 month ago

2163

Stanford Medicine Study Challenges Traditional Views on Agin...

1 month ago

2097

Federal Government Refuses CN's Request for Intervention in ...

1 month ago

2011

Trending in United States of America

Popular

Nokia Reaches 5G Patent Agreement with Vivo After Lengthy Le...

7 months ago

26048

Apple's Upcoming Tablet Lineup: iPad Air to Introduce Two Si...

9 months ago

25976

Xiaomi's First Electric Car, the SU7 Sedan, Enters the EV Ma...

8 months ago

25364

The European Parliament's Bold Move to Combat Smartphone Add...

9 months ago

25312

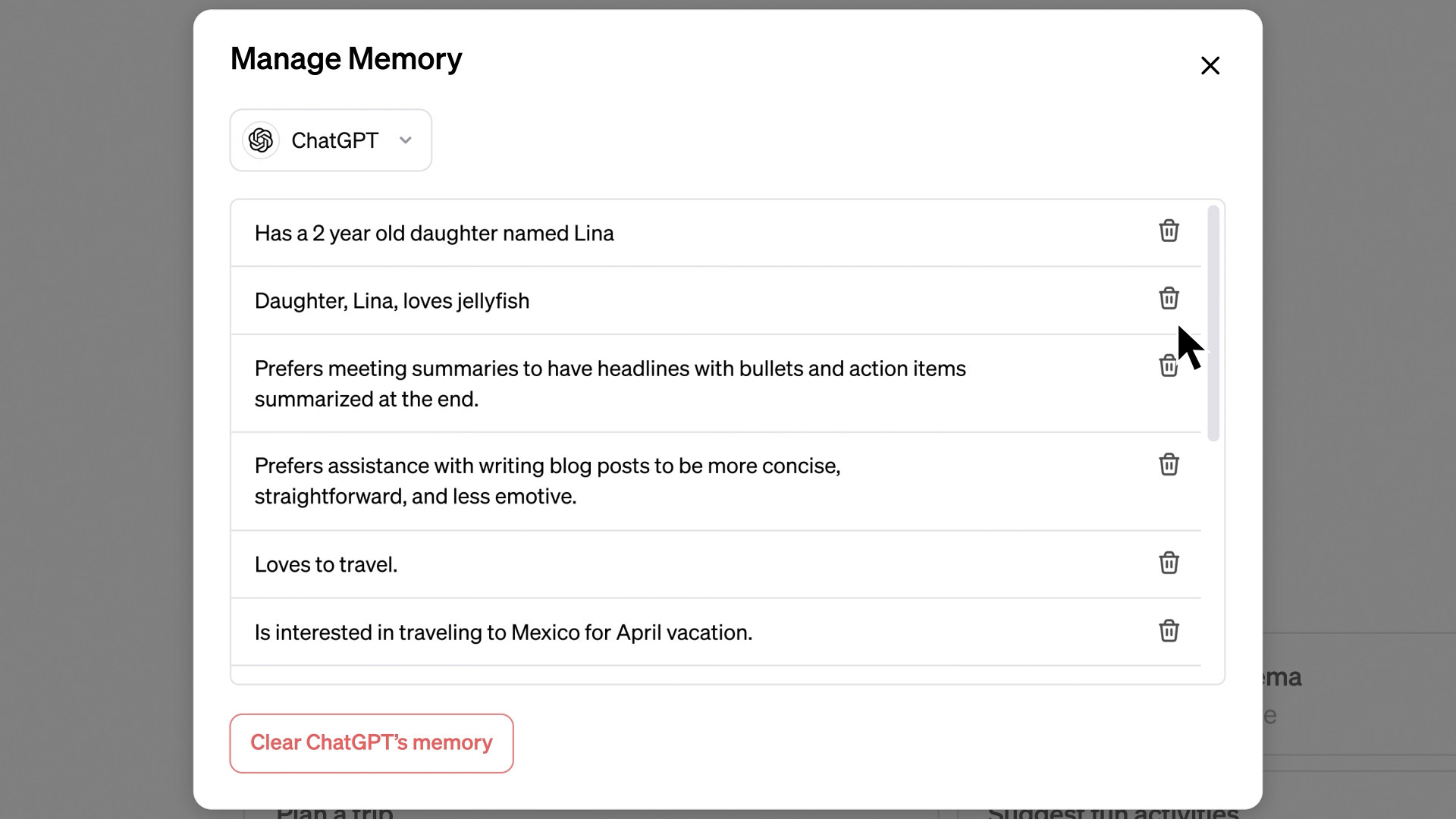

Unveiling ChatGPT's New 'Memory' Feature Revolutionizing Use...

7 months ago

25212

© OriginSources 2024. All rights are reserved

English (US)

English (US)