Tesla's first quarter financial results for the year show a significant drop in net income compared to the same period last year. The electric vehicle maker reported a 55% decrease in net income, attributing the decline to falling global sales and price cuts that impacted revenue and profit margins. During the first quarter of the year, Tesla generated $1.13 billion in revenue, down from $2.51 billion in the same period a year ago. The company cited a nine percent decrease in worldwide sales, which was influenced by increased competition and a slowing demand for electric vehicles.

Additionally, Tesla faced challenges including an arson attack at its German plant and factory downtime as it transitioned to a new version of the Model 3 sedan. Excluding one-time items, such as stock-based compensation, Tesla earned 45 cents per share, missing analyst estimates of 49 cents according to FactSet. The company's gross profit margin also declined to 17.4%, compared to 19.3% from the previous year and a peak of 29.1% in the first quarter of 2022. In a letter to investors, Tesla hinted at lower vehicle sales growth compared to the previous year as it focuses on launching its next-generation vehicle, possibly the small Model 2. The Model 2 is anticipated to be priced around $25,000, making it more appealing to mass-market consumers. The company is also banking on a fully autonomous robotaxi as a key driver for future earnings growth, with CEO Elon Musk announcing plans for its unveiling on August 8. Despite the financial setbacks, Tesla's stock rose 5.2% in after-hours trading following the earnings report. However, the stock has declined by more than 40% since the beginning of the year, while the S&P 500 index has seen a five percent increase. Analysts and investors are eager for more details during the earnings conference call, particularly regarding the decline in sales and demand for Tesla vehicles. Musk's emphasis on the potential of the robotaxi as a growth catalyst has raised questions, especially as the autonomous capabilities of Tesla vehicles have faced delays and challenges. Recent price cuts on several Tesla models, along with reductions in the cost of the "Full Self Driving" feature, have signaled an attempt to stimulate demand in the face of weaker EV sales. Bank of America Global Research analyst John Murphy expressed skepticism about Tesla's growth prospects but also highlighted potential opportunities with the introduction of future growth drivers like the robotaxi and Model 2. Tesla's production figures for the first quarter showed an output of 433,371 vehicles, with deliveries totaling 386,810. Despite manufacturing more vehicles than it sold, Tesla's decision to reduce prices last year, coupled with the announcement of layoffs and executive departures, reflect the company's efforts to streamline operations and improve financial performance. Looking ahead, investors are eager to hear updates from Musk and the company regarding plans for the robotaxi and the timeline for launching the Model 2. As Tesla continues to navigate challenges in the EV market and autonomous driving technology, the company faces scrutiny from industry analysts and skepticism about its long-term growth potential. As Tesla grapples with evolving market dynamics and technological advancements, the company's ability to deliver on its promises and maintain competitive positioning in the electric vehicle sector will be critical for its future success.Tesla's first-quarter profits decline due to lower global sales and price reductions.

4 months ago

2602

4 months ago

2602

- Homepage

- Business & Finance

- Tesla's first-quarter profits decline due to lower global sales and price reductions.

Related

Impending Work Stoppage at Canada's Top Railroads May Disrup...

1 month ago

2163

Stanford Medicine Study Challenges Traditional Views on Agin...

1 month ago

2097

Federal Government Refuses CN's Request for Intervention in ...

1 month ago

2011

Trending in United States of America

Popular

Nokia Reaches 5G Patent Agreement with Vivo After Lengthy Le...

7 months ago

26048

Apple's Upcoming Tablet Lineup: iPad Air to Introduce Two Si...

9 months ago

25976

Xiaomi's First Electric Car, the SU7 Sedan, Enters the EV Ma...

8 months ago

25364

The European Parliament's Bold Move to Combat Smartphone Add...

9 months ago

25312

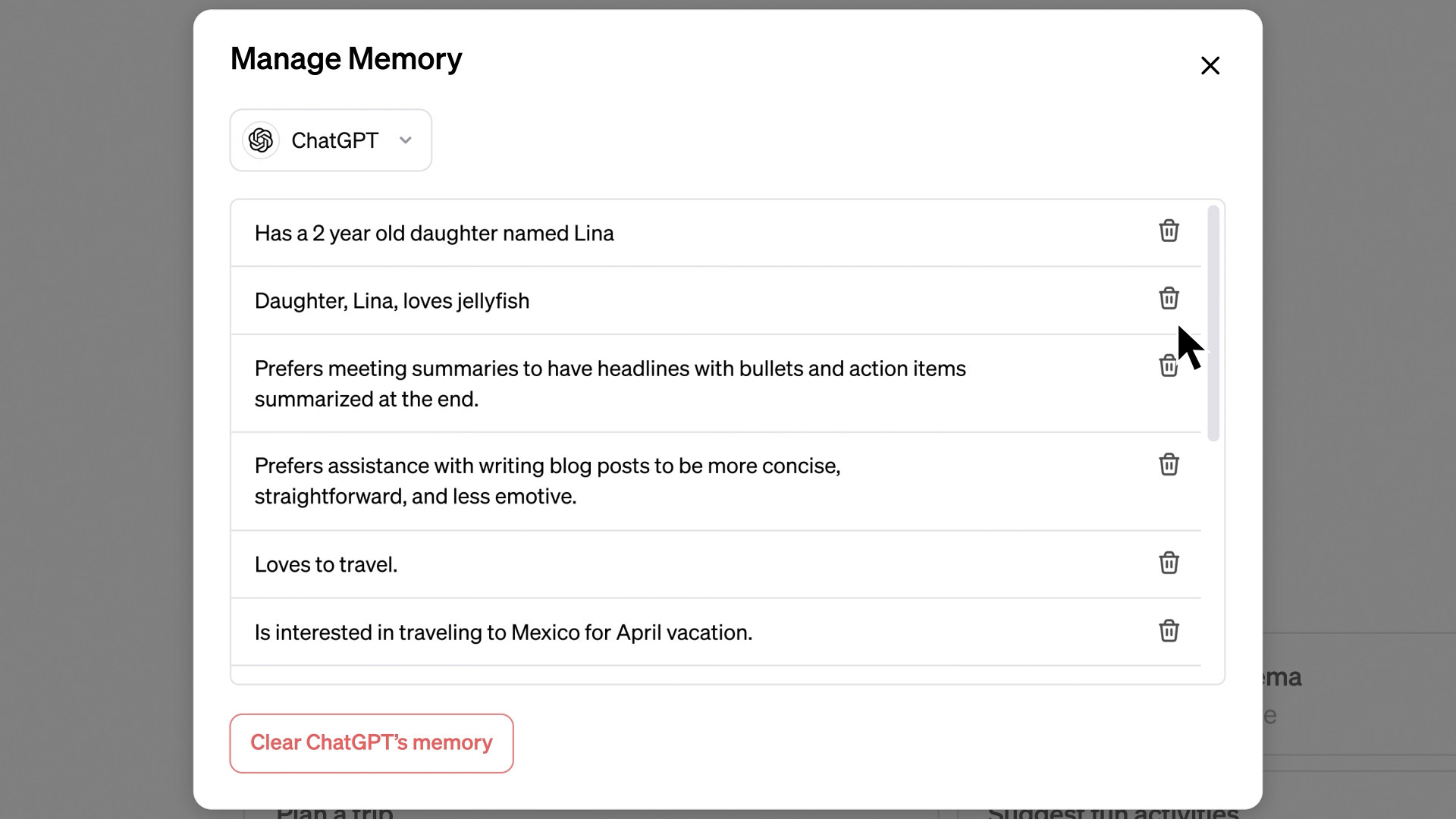

Unveiling ChatGPT's New 'Memory' Feature Revolutionizing Use...

7 months ago

25212

© OriginSources 2024. All rights are reserved

English (US)

English (US)