Preparing financially for maternity leave is an essential step for expectant parents, as it can help alleviate stress and ensure a smoother transition into parenthood. While painting the nursery and choosing baby gear are exciting tasks, financial planning should not be overlooked. Experts emphasize the importance of understanding the benefits available and budgeting accordingly to ensure financial stability during the maternity leave period.

Samantha Sykes, a financial planner at Raymond James Ltd., emphasizes the significance of planning ahead and learning about the various benefits available from both the workplace and the government. Understanding the support systems in place can help parents-to-be determine how to manage their finances while they are away from work. In Canada, working women are eligible for employment insurance for either 12 or 18 months when on maternity leave, with payments amounting to 55% of their earnings up to a maximum of $668 per week. However, financial planner Cindy Marques cautions that the actual amount received through EI benefits may be lower than expected, especially for individuals with higher incomes. Additionally, EI payments are calculated based on various factors such as regional unemployment rates and the number of weeks worked. Planning for maternity leave requires a deep understanding of these benefits and a realistic assessment of the financial support they provide. Allison Venditti, of Moms At Work, highlights the importance of exploring additional benefits provided by the workplace, such as top-up payments or insurance options. It's essential for expectant mothers to consider all sources of financial support available to them, including short-term disability coverage in case of medical complications during pregnancy. Self-employed individuals can also access EI benefits by enrolling in deductions beforehand. When budgeting for maternity leave, it's crucial to account for all expenses, both essential and non-essential. In addition to daily living costs, parents-to-be need to factor in expenses related to the baby, such as formula, diapers, and baby gear. Financial planner Marques emphasizes the importance of foresight and planning, suggesting setting up a high-interest savings account as soon as pregnancy is confirmed. Planning for maternity leave also involves making decisions about saving and setting aside money for the future. Venditti advises starting to save as early as possible, even several years before planning to have a child. Sykes recommends paying down debt and discussing financial goals with mothers of young children to better understand the financial implications of raising a child. As maternity leave is a significant life transition, it's essential to communicate with human resources and seek advice from financial professionals to ensure adequate financial preparation. Planning for future pregnancies and understanding the implications on work and benefits is also crucial. Despite the financial challenges of raising young children, experts remind parents to give themselves grace and prioritize the well-being of their family. In conclusion, preparing financially for maternity leave is a vital aspect of planning for parenthood. By understanding the available benefits, budgeting effectively, and seeking additional support, expectant parents can navigate the maternity leave period with confidence and peace of mind. The financial decisions made during this time can have a lasting impact on the family's financial well-being and overall stability."Taking Maternity Leave Affordably: Tips for Moms-to-Be"

4 months ago

2215

4 months ago

2215

- Homepage

- Gossips & Lifestyle

- "Taking Maternity Leave Affordably: Tips for Moms-to-Be"

Related

"Meghan Markle's Heartfelt Tribute to Princess Diana Through...

1 month ago

2025

Prince Harry and Meghan, Duke and Duchess of Sussex, Delve i...

1 month ago

2073

Annual 'All-Access Fly Pass' Announced by European Airline

1 month ago

2047

Trending in United States of America

Popular

Nokia Reaches 5G Patent Agreement with Vivo After Lengthy Le...

7 months ago

26048

Apple's Upcoming Tablet Lineup: iPad Air to Introduce Two Si...

9 months ago

25976

Xiaomi's First Electric Car, the SU7 Sedan, Enters the EV Ma...

8 months ago

25364

The European Parliament's Bold Move to Combat Smartphone Add...

9 months ago

25312

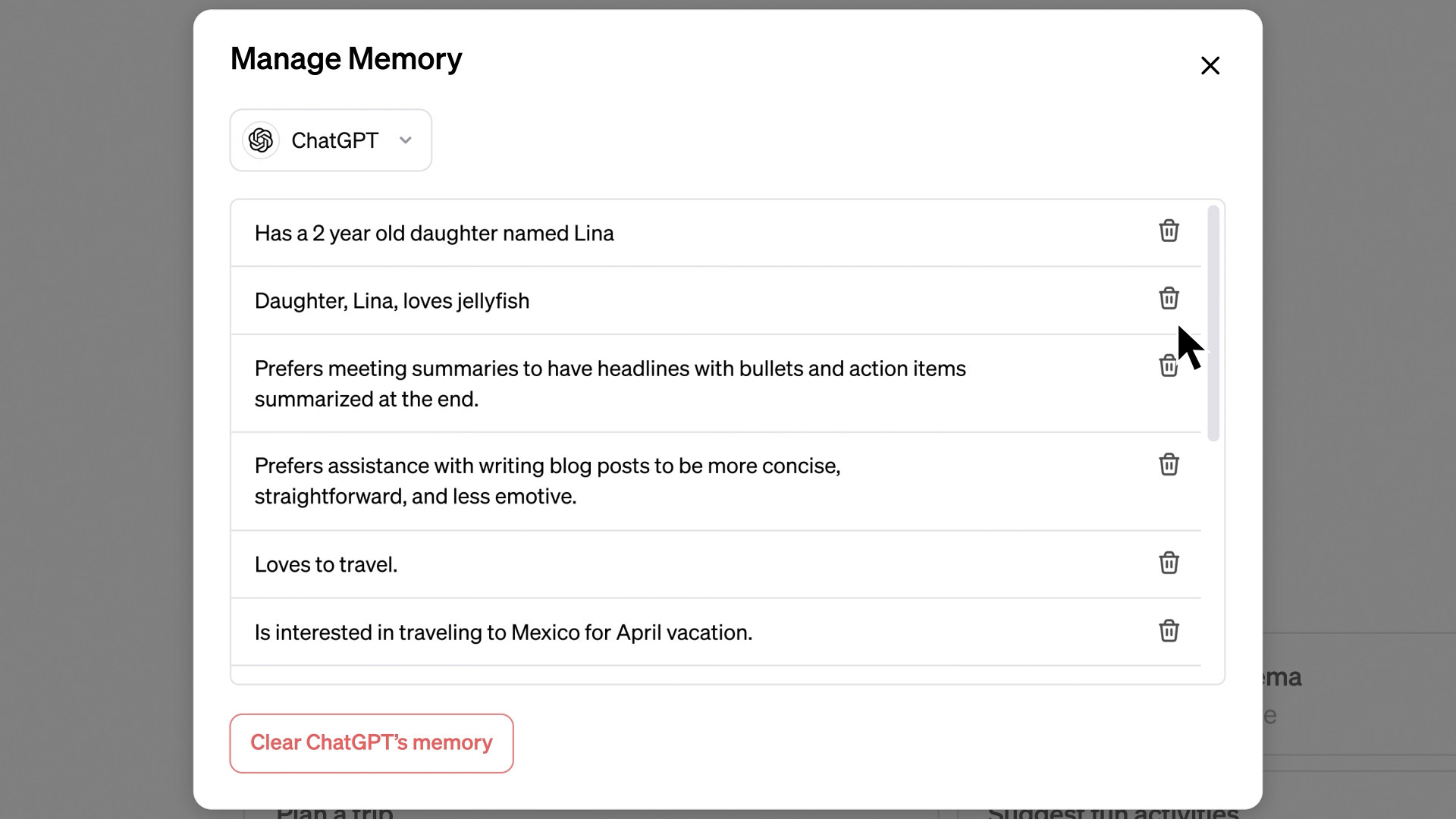

Unveiling ChatGPT's New 'Memory' Feature Revolutionizing Use...

7 months ago

25212

© OriginSources 2024. All rights are reserved

English (US)

English (US)