Exxon Mobil recently made headlines with its acquisition of Pioneer Natural Resources for a whopping $60 billion, solidifying its position as a major player in the oil industry. However, this deal hasn't been without its fair share of controversy, particularly concerning the appointment of Scott Sheffield, formerly of Pioneer, to Exxon Mobil's board. The Federal Trade Commission stepped in and blocked Sheffield from taking on his intended role on the board, citing allegations of collusion with OPEC and other U.

S. oil companies to manipulate production levels and boost profits. These accusations were fueled by reports of meetings where Sheffield and other industry veterans, such as Vicki Hollub of Occidental Petroleum, Rick Muncrief of Devon Energy, Nick Dell'Osso of Chesapeake Energy, and John Hess of Hess, allegedly discussed strategies to influence market conditions. Pioneer (PXD) came to Sheffield's defense, highlighting his track record of success and dedication to promoting stability in the industry while prioritizing shareholder interests. However, the FTC's actions have raised questions about their motivations and the potential implications for future deals in the sector. Some observers speculate that Sheffield's exclusion from Exxon Mobil's board could be linked to his vocal advocacy for market stability and shareholder value, positions that may not align with the FTC's current regulatory agenda. With the upcoming presidential election adding another layer of uncertainty, the FTC's enforcement actions may be seen as a way to flex its regulatory muscle and signal a tougher approach to industry oversight. The ripple effects of the FTC's scrutiny extend beyond just Sheffield and Pioneer, as there are concerns that this case could trigger a broader investigation into possible collusion and anti-competitive practices within the oil sector. As the regulatory body delves deeper into past communications and interactions among industry players, other companies that have engaged in similar transactions may find themselves under increased scrutiny. The oil industry is no stranger to regulatory challenges, but the current spotlight on Sheffield and Pioneer's merger underscores the heightened scrutiny facing energy companies in today's regulatory climate. As stakeholders navigate this uncertain landscape, it's clear that transparency and compliance will be key priorities for companies looking to avoid regulatory pitfalls and maintain their competitive edge. In conclusion, Exxon Mobil's acquisition of Pioneer Natural Resources may have marked a significant milestone in the oil industry, but the controversy surrounding Scott Sheffield's board appointment underscores the complex regulatory environment in which energy companies operate. As the sector grapples with evolving regulatory standards and heightened scrutiny, companies must remain vigilant in addressing compliance risks and upholding transparency to navigate an increasingly challenging landscape.FTC's targeting of top executive sends shockwaves through oil industry, raises alarms about deals

4 months ago

1322

4 months ago

1322

- Homepage

- Business & Finance

- FTC's targeting of top executive sends shockwaves through oil industry, raises alarms about deals

Related

Impending Work Stoppage at Canada's Top Railroads May Disrup...

1 month ago

2163

Stanford Medicine Study Challenges Traditional Views on Agin...

1 month ago

2097

Federal Government Refuses CN's Request for Intervention in ...

1 month ago

2011

Trending in United States of America

Popular

Nokia Reaches 5G Patent Agreement with Vivo After Lengthy Le...

7 months ago

26048

Apple's Upcoming Tablet Lineup: iPad Air to Introduce Two Si...

9 months ago

25976

Xiaomi's First Electric Car, the SU7 Sedan, Enters the EV Ma...

8 months ago

25364

The European Parliament's Bold Move to Combat Smartphone Add...

9 months ago

25312

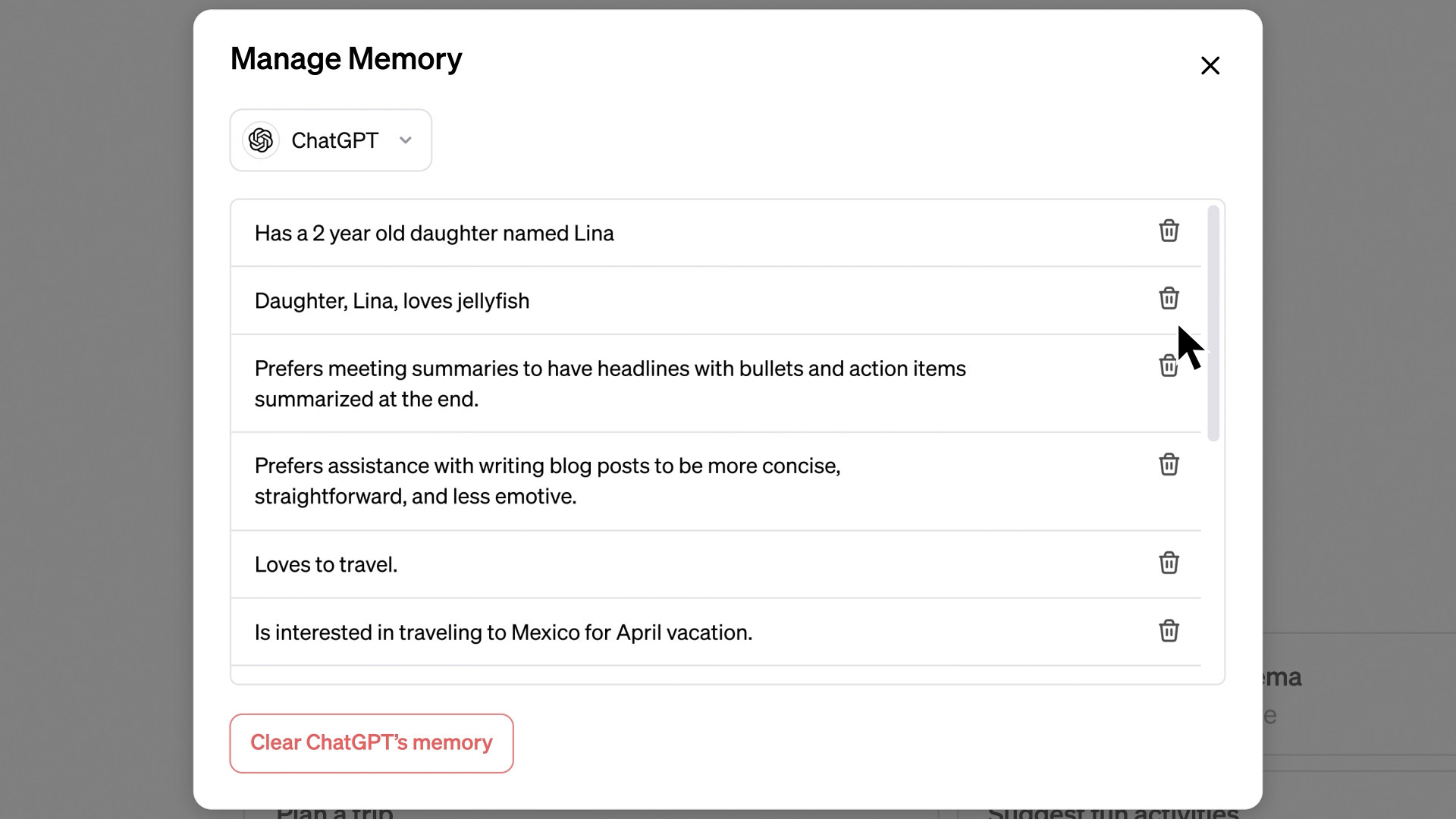

Unveiling ChatGPT's New 'Memory' Feature Revolutionizing Use...

7 months ago

25212

© OriginSources 2024. All rights are reserved

English (US)

English (US)