Title and mortgage fraud are on the rise in Canada, with homeowners at risk of falling victim to these schemes. With the advancement of technology, fraudsters have become more sophisticated in their methods of obtaining mortgages under false pretenses or changing property ownership through forged documents. As a result, it is essential for homeowners to take proactive steps to protect their properties and identities.

One common form of fraud is mortgage fraud, where fraudsters use stolen identities to secure mortgages from lenders. This can lead to homeowners receiving notices of default from banks for mortgages they never took out. In extreme cases, homes have been listed for sale without the owner's knowledge, and in some instances, the properties have been sold without the owner's consent. These situations can be stressful and costly for the true homeowners to rectify. Title fraud, on the other hand, occurs when the ownership or title of a property is fraudulently changed, allowing fraudsters to sell or refinance the property illegally. Both forms of fraud can have serious consequences for homeowners, resulting in financial losses and legal battles to prove their innocence. To protect against title and mortgage fraud, experts recommend homeowners consider purchasing title insurance. Title insurance can provide financial protection in the event of fraud, covering the costs associated with proving ownership and rectifying fraudulent transactions. The cost of title insurance is relatively low compared to the potential financial losses homeowners may face without it. Newcomers to Canada and seniors are often targeted by fraudsters due to factors such as language barriers and the likelihood of owning mortgage-free homes. Seniors, in particular, are at risk as they may have owned their homes for many years, making them attractive targets for fraudsters. With the increasing use of remote technology and digital verification methods, the risk of fraud has only grown during the pandemic. In response to the growing threat of mortgage fraud, regulatory authorities have issued guidance for brokers to monitor for red flags and conduct business ethically. Brokers are now required to verify clients' identities and ensure they have the authority to mortgage a property, among other obligations. Failure to comply with these requirements could result in enforcement actions by regulatory authorities. Overall, the rise in title and mortgage fraud highlights the importance of vigilance and proactive measures to protect homeowners' properties and identities. By being aware of the risks and taking steps to mitigate them, homeowners can reduce their vulnerability to fraud and safeguard their most valuable asset – their home.Experts advise homeowners and realtors to safeguard against title fraud

6 months ago

2472

6 months ago

2472

- Homepage

- Business & Finance

- Experts advise homeowners and realtors to safeguard against title fraud

Related

Impending Work Stoppage at Canada's Top Railroads May Disrup...

1 month ago

2163

Stanford Medicine Study Challenges Traditional Views on Agin...

1 month ago

2097

Federal Government Refuses CN's Request for Intervention in ...

1 month ago

2011

Trending in United States of America

Popular

Nokia Reaches 5G Patent Agreement with Vivo After Lengthy Le...

7 months ago

26048

Apple's Upcoming Tablet Lineup: iPad Air to Introduce Two Si...

9 months ago

25976

Xiaomi's First Electric Car, the SU7 Sedan, Enters the EV Ma...

8 months ago

25364

The European Parliament's Bold Move to Combat Smartphone Add...

9 months ago

25312

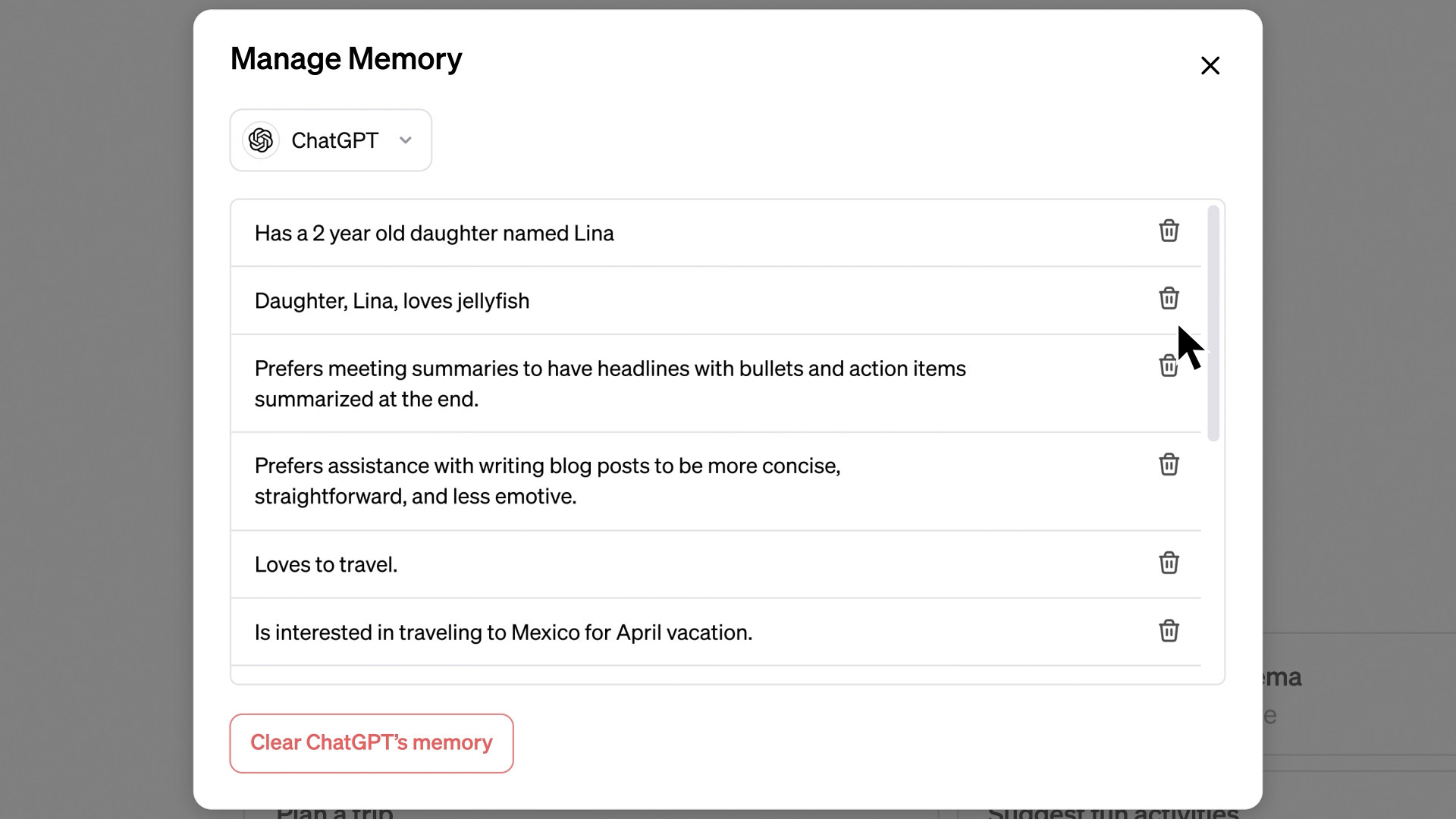

Unveiling ChatGPT's New 'Memory' Feature Revolutionizing Use...

7 months ago

25212

© OriginSources 2024. All rights are reserved

English (US)

English (US)