Economists are predicting that inflation may have risen again in February, driven by higher gasoline prices. This is expected to complicate the journey back to the Bank of Canada's two per cent inflation target. The February consumer price index report from Statistics Canada is set to be released soon, with the consensus forecast suggesting a 3.1 per cent increase from a year ago. This would reverse the previous month's slowdown to 2.9 per cent.

Royce Mendes, managing director and head of macro strategy at Desjardins, anticipates that inflation will pick up due to higher energy prices in February. He believes that inflation will hover around the three per cent mark for the next few months. This uptick in inflation poses a challenge for the Bank of Canada, which is expected to begin cutting its policy interest rate in the near future. Mendes emphasizes the importance of looking beyond the headline inflation figure to understand the underlying price pressures. The Bank of Canada is closely monitoring these measures to gauge the direction of inflation. Governor Tiff Macklem highlighted that nearly half of the consumer price index components are currently rising at a pace above three per cent, signaling elevated inflationary pressures. The central bank is cautious about lowering interest rates prematurely and is waiting for clearer evidence that inflation is on track to meet its target. BMO chief economist Douglas Porter considers caution as a key factor in the bank's decision-making process. The central bank has kept its key interest rate unchanged since July, awaiting more evidence of inflation stabilization. Porter points out that energy prices are a significant source of uncertainty in inflation forecasts, as they can fluctuate rapidly and impact overall inflation figures. The upcoming inflation report will be crucial in shaping the Bank of Canada's decision-making process leading up to its April interest rate announcement. While no change in the policy rate is expected next month, many analysts anticipate a rate cut in June. The federal government is scheduled to present its budget shortly after the April rate decision, potentially influencing the inflation outlook. The Bank of Canada will have two more months of economic data to assess before making its June decision. Porter believes that the central bank will proceed with caution and carefully evaluate the economic conditions before making any significant moves. In conclusion, the path to reaching the Bank of Canada's two per cent inflation target is expected to be challenging, with inflationary pressures likely to persist in the coming months. The central bank's decision-making process will be influenced by a range of factors, including energy prices, economic data, and government policies. With uncertainty lingering, market participants will closely monitor the upcoming inflation report and subsequent policy decisions by the Bank of Canada.Economists anticipate inflation rising above 3% due to higher gas prices

6 months ago

2234

6 months ago

2234

- Homepage

- Business & Finance

- Economists anticipate inflation rising above 3% due to higher gas prices

Related

Impending Work Stoppage at Canada's Top Railroads May Disrup...

1 month ago

2163

Stanford Medicine Study Challenges Traditional Views on Agin...

1 month ago

2097

Federal Government Refuses CN's Request for Intervention in ...

1 month ago

2011

Trending in United States of America

Popular

Nokia Reaches 5G Patent Agreement with Vivo After Lengthy Le...

7 months ago

26048

Apple's Upcoming Tablet Lineup: iPad Air to Introduce Two Si...

9 months ago

25976

Xiaomi's First Electric Car, the SU7 Sedan, Enters the EV Ma...

8 months ago

25364

The European Parliament's Bold Move to Combat Smartphone Add...

9 months ago

25312

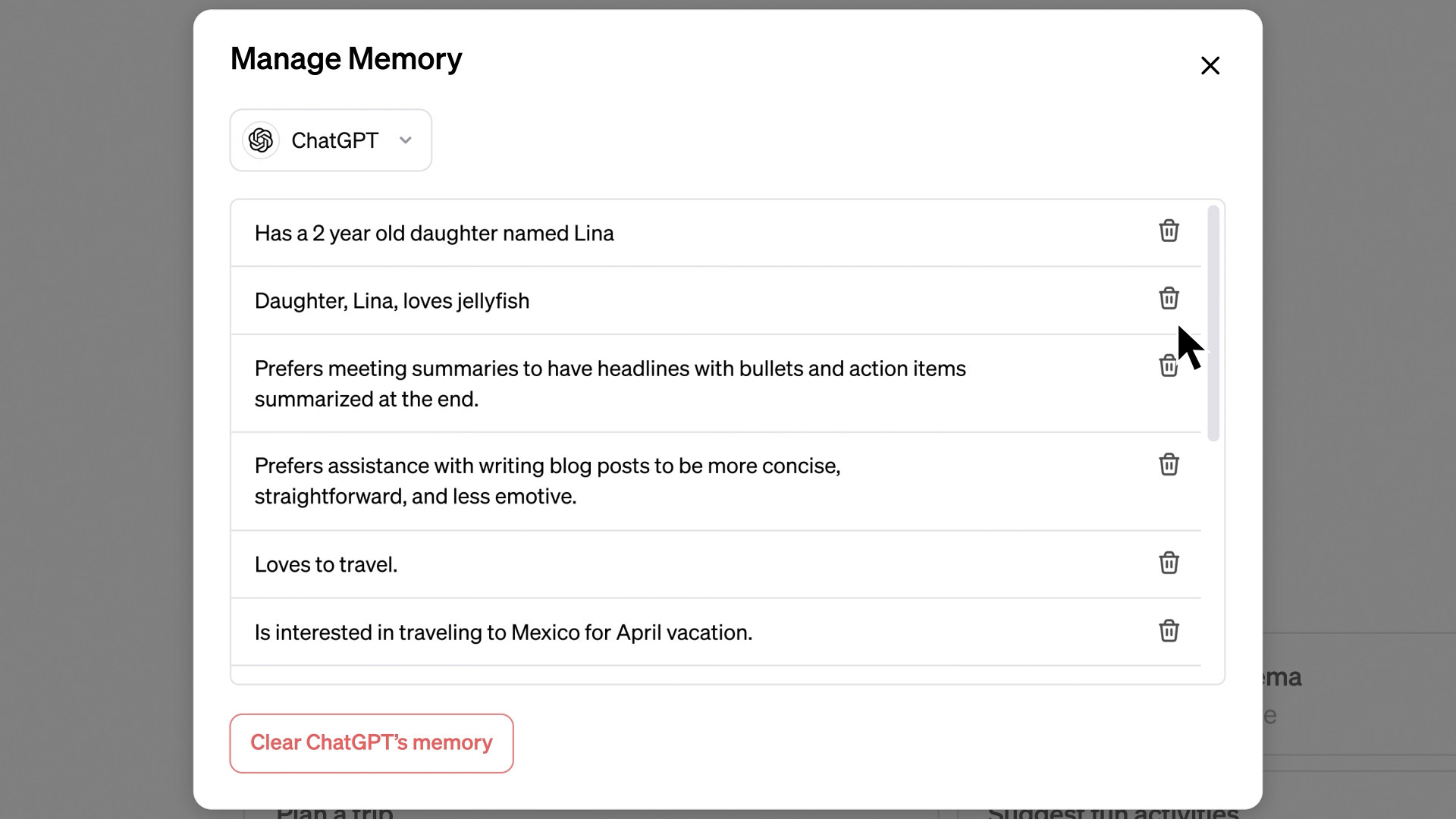

Unveiling ChatGPT's New 'Memory' Feature Revolutionizing Use...

7 months ago

25212

© OriginSources 2024. All rights are reserved

English (US)

English (US)