Filing taxes can be a daunting task, but with the rise of self-filing software, more people are opting to do it themselves. Andrea Thompson, a certified financial planner, highlights the simplicity and cost-saving benefits of using online platforms to file taxes. For those with straightforward returns, such as full-time employees with basic deductions, self-filing can be a viable option.

Corby Simpson, a tech company owner, has been self-filing his taxes for 20 years out of curiosity and to save money. He emphasizes the convenience of online tax filing systems and how he educated himself on handling new components as his tax situation evolved. Websites like TurboTax and Wealthsimple, along with resources provided by the Canada Revenue Agency, offer assistance to streamline the tax return process. The CRA provides a list of free or pay-what-you-want tax software for Canadians to utilize. Brian Quinlan, a chartered professional accountant, recommends self-filers to be mindful of lifestyle changes that can impact taxes, such as starting a new business or major life events like marriage or the birth of a child. While errors may occur, Quinlan reassures taxpayers that returns can be amended if needed. Despite the accessibility of online resources, some individuals may still prefer to hire an accountant for more complex tax situations. An accountant can provide peace of mind and expertise in handling investments, capital gains, or rental properties, in addition to offering advice on tax management and savings strategies. The key to a successful tax-filing experience lies in the comfort level of the individual. Whether choosing to DIY or seek professional help, it's essential to feel confident and knowledgeable about the process. Ultimately, the decision comes down to personal preference and the complexity of one's tax situation. Finding the right accountant is crucial, as it involves establishing trust and compatibility. Quinlan emphasizes the importance of feeling comfortable with an accountant and ensuring timely and accurate filing of returns. While the cost of hiring an accountant can vary depending on complexity, the benefits of expert guidance and peace of mind may outweigh the expense. In conclusion, whether opting for self-filing or professional assistance, the goal is to effectively manage taxes according to individual needs and comfort levels. Basic math skills, patience, and confidence are key factors in navigating the tax-filing process successfully. The choice between DIY and hiring an accountant ultimately rests with the taxpayer, with the end goal of fulfilling tax obligations accurately and efficiently.Determining When to Hire a Professional vs. Using Tax Return Software for Easy Filing

6 months ago

2618

6 months ago

2618

- Homepage

- Business & Finance

- Determining When to Hire a Professional vs. Using Tax Return Software for Easy Filing

Related

Impending Work Stoppage at Canada's Top Railroads May Disrup...

1 month ago

2163

Stanford Medicine Study Challenges Traditional Views on Agin...

1 month ago

2097

Federal Government Refuses CN's Request for Intervention in ...

1 month ago

2011

Trending in United States of America

Popular

Nokia Reaches 5G Patent Agreement with Vivo After Lengthy Le...

7 months ago

26048

Apple's Upcoming Tablet Lineup: iPad Air to Introduce Two Si...

9 months ago

25976

Xiaomi's First Electric Car, the SU7 Sedan, Enters the EV Ma...

8 months ago

25364

The European Parliament's Bold Move to Combat Smartphone Add...

9 months ago

25312

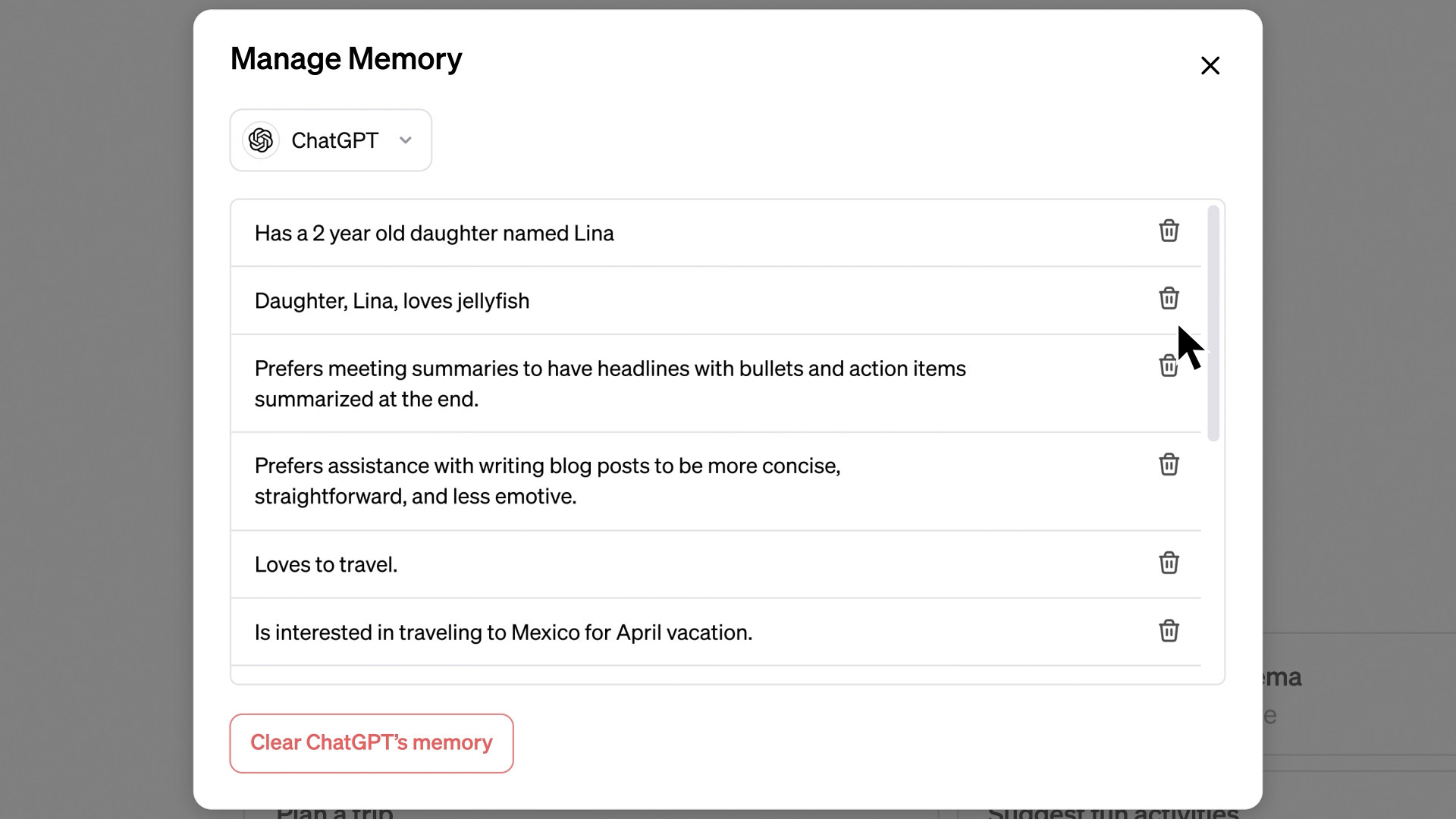

Unveiling ChatGPT's New 'Memory' Feature Revolutionizing Use...

7 months ago

25212

© OriginSources 2024. All rights are reserved

English (US)

English (US)